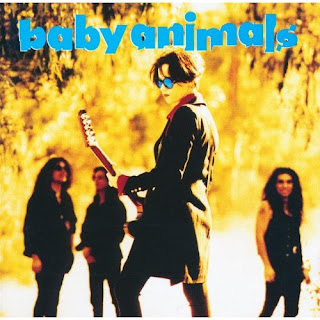

Friday music for you that you might not have come across before.

Check out Baby Animals - http://amzn.to/2ymimUl

Old school, lead female rock guitarist band that should have gotten way more airplay globally than they managed. (though back then very different times).

Suze Demarchi dominates the entire album and I recommend this to everyone once they've heard of Cold Chisel, the Angels, Screaming Jets etc etc and looking for something along similar lines from Australia.

Rock the House! Play it loud.

Even though was released in 1991 still sounds fresh and viable as anything you'll hear today.

Friday, October 20, 2017

Tuesday, October 17, 2017

Australian expat property investors....taxation without representation?

Some of us aussies are getting together Wednesday night to discuss recent govt changes to expats who own property in Australia.

With the recent budget hikes for our rental income and capital gains returns its getting ridiculous to continue owning Aussie property eg we now pay 41c minimum tax (instead of say 20c in USA equities) and last years tax changes on PPOR may be the final straw for many of us working here temporarily in New York.

Its a free seminar from the guys at SMATS so hopefully we can get some insights as to is it going to get worse before it gets better....and should we be investing our savings where they are appreciated.....

Register here - http://www.aussieproperty.com/Events/Property-Update-Seminar/New-York-11Th-Annual-Market-Update-Seminar-2017/32a440e8-36a8-1423-1542-c7c089329145/720370b1-7599-4856-a918-98e697e52f9e

Since then, there has been an escalation in the costs of Australian property ownership with dramatic increases in land tax and the introduction of buyers fees, additional stamp duty and the new vacancy tax. All of this at a time when lending for offshore investors continues to be problematic.

The latest proposal is now to remove the tax free c...oncession for expatriate's principal residence if their former home is sold when living out of Australia. Where do these changes end and what can we do to try an halt the aggressive attack on foreign investors in Australian property market?

With media fuelling the fire and foreigners an easy blame target for lifting prices, there is little sympathy in Australia to the plight of overseas owners, so any change will need to come from our own efforts.

Join us for this seminar to find out:

• All the recent changes in ownership and acquisition costs for foreign investors and expatriates;

• Strategies to protect yourself against rising costs;

• If it is time to consider selling your property;

• The current position of Australian property markets and the outlook for 2018;

• How international markets may track in the coming year;

• If the recent uplift in the Australian dollar is sustainable; and

• Current lending options and costings.

Free Admission

With the recent budget hikes for our rental income and capital gains returns its getting ridiculous to continue owning Aussie property eg we now pay 41c minimum tax (instead of say 20c in USA equities) and last years tax changes on PPOR may be the final straw for many of us working here temporarily in New York.

Its a free seminar from the guys at SMATS so hopefully we can get some insights as to is it going to get worse before it gets better....and should we be investing our savings where they are appreciated.....

Register here - http://www.aussieproperty.com/Events/Property-Update-Seminar/New-York-11Th-Annual-Market-Update-Seminar-2017/32a440e8-36a8-1423-1542-c7c089329145/720370b1-7599-4856-a918-98e697e52f9e

In 2012 the Capital Gains Tax Rules were changed in Australia to remove the 50% tax discount for owners living out of Australia. This signalled a change of intent from appreciating foreign investment to seeing an opportunity to increase Government revenue.Since then, there has been an escalation in the costs of Australian property ownership with dramatic increases in land tax and the introduction of buyers fees, additional stamp duty and the new vacancy tax. All of this at a time when lending for offshore investors continues to be problematic.

The latest proposal is now to remove the tax free c...oncession for expatriate's principal residence if their former home is sold when living out of Australia. Where do these changes end and what can we do to try an halt the aggressive attack on foreign investors in Australian property market?

With media fuelling the fire and foreigners an easy blame target for lifting prices, there is little sympathy in Australia to the plight of overseas owners, so any change will need to come from our own efforts.

Join us for this seminar to find out:

• All the recent changes in ownership and acquisition costs for foreign investors and expatriates;

• Strategies to protect yourself against rising costs;

• If it is time to consider selling your property;

• The current position of Australian property markets and the outlook for 2018;

• How international markets may track in the coming year;

• If the recent uplift in the Australian dollar is sustainable; and

• Current lending options and costings.

Free Admission

Monday, October 16, 2017

Is it time to get rid of cd's?

Nope never going to give up cd collection, they are the last form of technology where you actually "own the content" and your rights cant be pulled ona whim by some company saying.....we want to change the T&C for your rights.

Dont get me wrong i cant remember the last time i listed to the cd but i purchase ALL my music on cd, rip it to my media server, then share it to all my media players/mobile devices etc from my private server.

This isnt like BluRay or DVD's where there was atechnical advantange so apart from a few indie bands i follow who dont release cd's......i've never missed out on anything by not signing up to iTunes.

Dont get me wrong i cant remember the last time i listed to the cd but i purchase ALL my music on cd, rip it to my media server, then share it to all my media players/mobile devices etc from my private server.

This isnt like BluRay or DVD's where there was atechnical advantange so apart from a few indie bands i follow who dont release cd's......i've never missed out on anything by not signing up to iTunes.

Victorian Government overstep in the rental market?

The government will also abolish "no specified reason" notices to vacate....

What's next telling investors when they have the right to sell.....?

What's next telling investors when they have the right to sell.....?

Friday, October 13, 2017

Bananarama concert.......squeee :)

I seriously have the best wife in the world. She fully accepts that i'm an 80's music junkie.....and thats why we are going to a Bananarama concert in Feb 18 :)

Tickets for PlayStation theatre just went on sale this morning in case you are also still a closet fan. https://www.axs.com/events/344316/bananarama-tickets

Tickets for PlayStation theatre just went on sale this morning in case you are also still a closet fan. https://www.axs.com/events/344316/bananarama-tickets

Wednesday, October 04, 2017

Australian property expensive compared to shares....or its just compound interest

Great article here comparing the long term returns of shares and property in Australia

http://www.yourinvestmentpropertymag.com.au/expert-advice/john-lindeman/a-bedtime-story-for-housing-investors-240981.aspx

When we compare the performance of shares and housing over the history of our nation we can see some interesting similarities, but also some crucial differences. The graph shows how each has performed since 1901 using a common index so that we can easily compare the critical changes that have taken place over the years.

Some of the easily noticeable external events are

• 1929 – The arrival of the Great Depression

• 1952 – The start of the Korean War

• 1960 – The Menzies Government Credit Squeeze

• 1974 – The ‘petrodollar’ crisis and Stagflation

• 1990 – The recession “We had to have”

• 2008 – The onset of the GFC

Proving yet again we don't have super expensive housing......Australians are just shit at calculating compound interest and both housing and shares rise about 7-8% over the long term, yes there will be dips and variance....but at the end of the day you need to be able to calculate 7-8% compound interest in your head.

The only reason our housing is expensive compared to say the USA is we keep insisting that everyone lives 20-40 mins commute from the center of 2 cbd's and until we decide to start populating tier 2 cities.....Australians will be paying over the average for our housing costs.

http://www.smh.com.au/business/the-economy/build-a-new-melbourne-every-decade-or-face-more-congestion-20161211-gt8x8c.html

The older I get the more I fail to understand why Australia doesn't understand the need for more than 2 big cities and 5 country towns.

Until we realize that Canberra, Bathurst, Orange, Port Macquarie, Nowra etc etc MUST be allowed to expand into fully fledged cities with self sustaining industry and jobs we are stuck in a vicious cycle of trying to squeeze more and more people into an expensive situation in Sydney and Melbourne.

Its time for Australia to grow up.

We need more #Tier2cities and we need them now.

http://www.yourinvestmentpropertymag.com.au/expert-advice/john-lindeman/a-bedtime-story-for-housing-investors-240981.aspx

When we compare the performance of shares and housing over the history of our nation we can see some interesting similarities, but also some crucial differences. The graph shows how each has performed since 1901 using a common index so that we can easily compare the critical changes that have taken place over the years.

Some of the easily noticeable external events are

• 1929 – The arrival of the Great Depression

• 1952 – The start of the Korean War

• 1960 – The Menzies Government Credit Squeeze

• 1974 – The ‘petrodollar’ crisis and Stagflation

• 1990 – The recession “We had to have”

• 2008 – The onset of the GFC

Proving yet again we don't have super expensive housing......Australians are just shit at calculating compound interest and both housing and shares rise about 7-8% over the long term, yes there will be dips and variance....but at the end of the day you need to be able to calculate 7-8% compound interest in your head.

The only reason our housing is expensive compared to say the USA is we keep insisting that everyone lives 20-40 mins commute from the center of 2 cbd's and until we decide to start populating tier 2 cities.....Australians will be paying over the average for our housing costs.

http://www.smh.com.au/business/the-economy/build-a-new-melbourne-every-decade-or-face-more-congestion-20161211-gt8x8c.html

The older I get the more I fail to understand why Australia doesn't understand the need for more than 2 big cities and 5 country towns.

Until we realize that Canberra, Bathurst, Orange, Port Macquarie, Nowra etc etc MUST be allowed to expand into fully fledged cities with self sustaining industry and jobs we are stuck in a vicious cycle of trying to squeeze more and more people into an expensive situation in Sydney and Melbourne.

Its time for Australia to grow up.

We need more #Tier2cities and we need them now.

Tuesday, October 03, 2017

The Reith Lectures

I'm @NowListening to @BBCRadio4 "Brian Cox on Robert Oppenheimer"

- http://www.bbc.co.uk/programmes/p05hctvq

#WorthyContent

- http://www.bbc.co.uk/programmes/p05hctvq

#WorthyContent

Subscribe to:

Posts (Atom)